A CIO’s Guide to Successful P&C Insurance Digital Transformation

- March 10, 2021

The modern insurance policyholder wants a hassle-free, self-service experience, is mobile-savvy, and is happy to buy policies from new players in the insurance industry – also known as InsurTech companies. In other words, consumers prefer P&C insurance companies that have already made their digital transformation.

When Covid-19 forced organizations to switch to remote work, 79% of insurance executives said the pandemic revealed “shortcomings in their company’s digital capabilities and transformation plans.”

Your P&C insurance business needs to begin its digital transformation if it hasn’t already, and a digital adoption platform (DAP) can help you achieve your goals. In this guide, we’ll cover everything there is to know for digital transformation in the P&C insurance industry.

What Is P&C Digital Transformation?

Digital transformation is the process of implementing cutting-edge technologies to improve every aspect of property and casualty (P&C) insurance companies. Examples include using online claims portals, AI-powered processing, big data, IoT, and more.

The Benefits of Digital Transformation on P&C Insurance

P&C insurers moving toward digital transformation feel positive ripples in their policyholder’s customer experience, their company’s bottom line, and their ability to scale and adapt to new processes.

1. Improved customer experience for policyholders

A digital transformation helps companies streamline the customer journey. Policyholders are able to access all information in one place: quotes for policies, claims prevention messages, first notice of loss, claims management, loss assessment, repair, and settlement. This aligns with customer expectations from insurance companies — timely wellness advice, a wide selection of policies, anxiety-reducing interactions, and quick payouts.

Digitally-savvy P&C insurers can also offer customers:

- Lower premiums: Root Insurance aggregates policyholder data points such as driving habits, credit scores, demographics, and location to offer better deals to good drivers. One study found that about half of customers are happy to share behavioral data in exchange for such benefits.

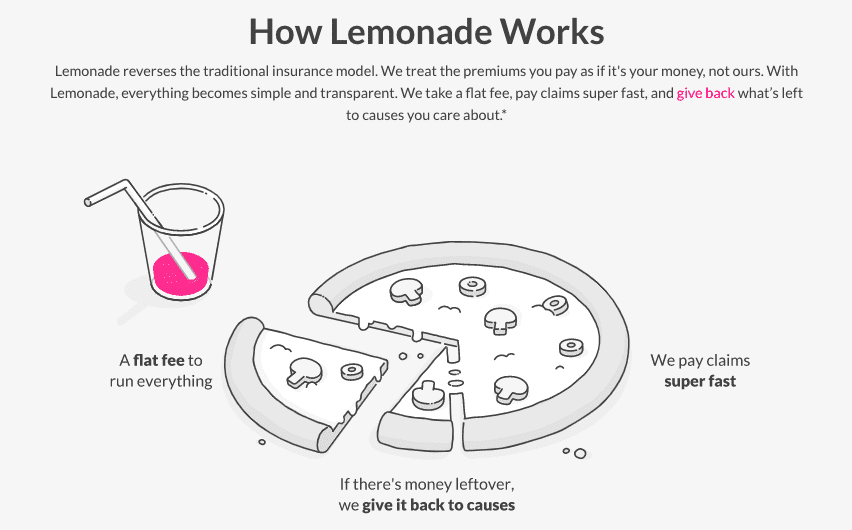

- Faster claims processing: Insurtech Lemonade’s claims bot assesses and pays out claims in three seconds. It also provides quotes for renters insurance and homeowners insurance in as little as two to three minutes.

- More claims transparency: Standardizing claims calculations with artificial intelligence (AI) allows customers to see a complete breakdown of their claims. This also reduces the chances of litigation for insurers.

2. Reduced costs for P&C insurance companies

Online self-service platforms, cloud storage, and automation improve efficiency and reduce the need for support and sales staff, which in turn reduces operating costs for insurance companies. This focus on digital-first operations is one reason why up-and-coming insurance tech companies already enjoy lower expense ratios (10-15%) compared to established insurers (25-35%).

Lower costs mean higher profits. As per one report, Ping An Life Insurance’s P&C unit grew operating profits 70.7% YoY, thanks to its investments in loss assessment and customer profiling technology.

3. Increased scalability

Self-service digital platforms allow companies to serve more customers while reducing pressure on customer support staff.

Case in point: AXA’s broker platform helps 3,000+ brokers see the status of the claims in real-time, identify suppliers, and track the next steps. Prior to using the platform, the company struggled with a never-ending stream of status update calls and low broker retention.

Another example of the benefits of P&C scalability is in catastrophe claims processing. When disasters, providers, and agents need to scramble quickly to provide great customer service and process claims quickly for policyholders that have gone through a traumatic event and make sure they’re comfortable.

4. Reduced risks & frauds

Smart devices in homes, cars, workspaces, wearables and drones help P&C insurance providers monitor policyholder activity and gauge risks. When a claim is filed, they help assess the damage and reduce instances of fraud.

The SmartRide program by Nationwide tracks miles driven, nighttime driving, hard braking, and acceleration to offer appropriate quotes.

Analytics and artificial intelligence platforms help insurers identify false claims. They refine social and publicly available data and apply it to claims decision-making.

5 Examples of Digital Technologies Transforming the P&C Industry

Here are five of the main pieces of technology driving the P&C insurance digital transformation in 2021.

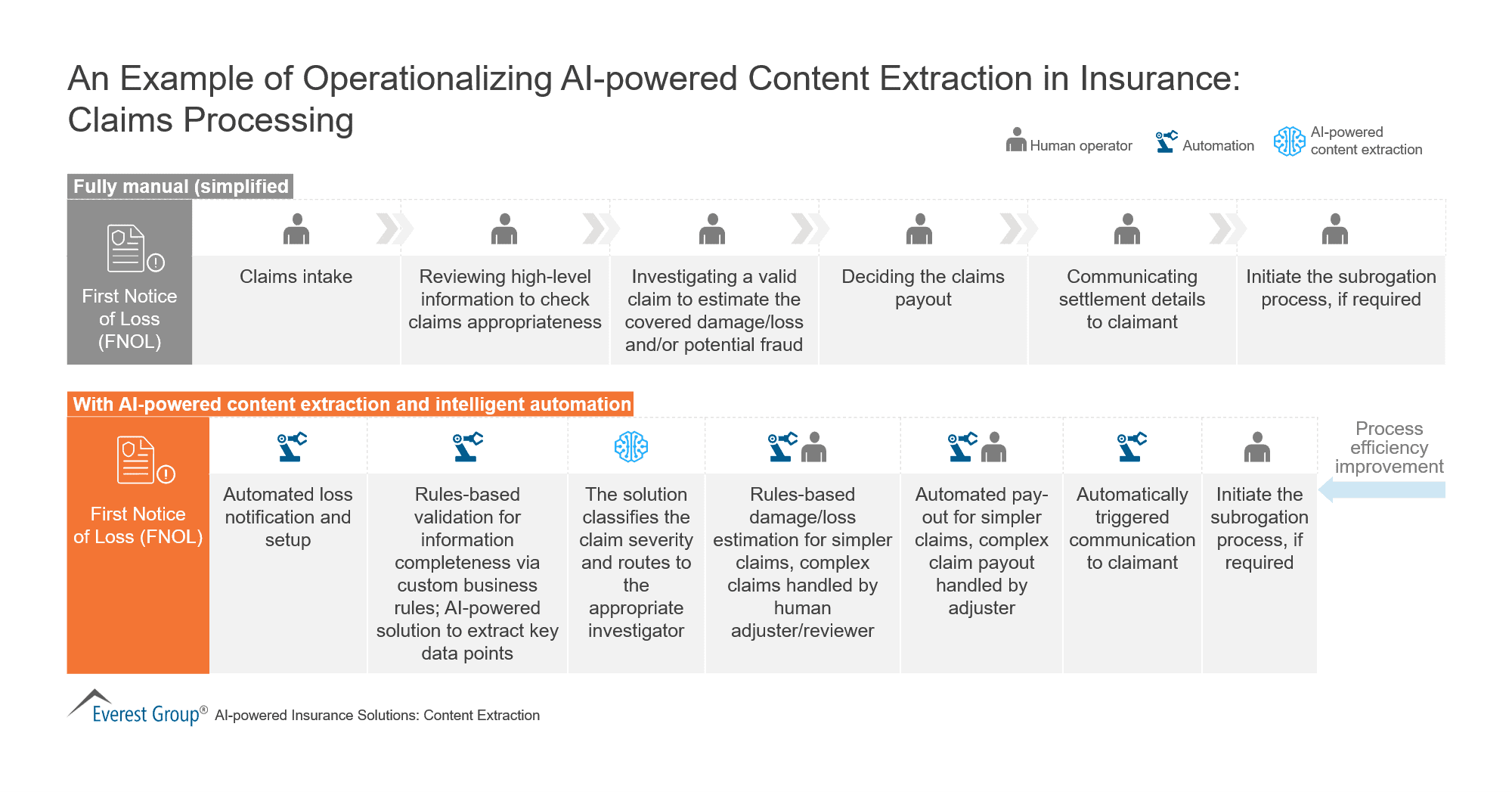

1. AI & automation reducing claims processing time & cost

Manual claims processing typically takes around 30 days or more. And because there are many people involved in the process, it’s susceptible to human error. Artificial intelligence (AI) and machine learning tools, on the other hand, reduce claims processing error rates to 0% and speed up the process by one to 15 days. AI has also decreased processing costs by 30%.

AI and machine learning tools continue to get more effective at identifying potentially fraudulent claims and estimating damages and losses because they continually analyze relevant data. These tools can also be programmed to handle repetitive tasks, like filing the first notice of loss (FNOL), freeing up time for your agents to do more thought-intensive activities.

One AI and machine learning tool that’s been changing the P&C insurance landscape is Lemonade, an InsurTech startup with an automated chatbot that has achieved the unimaginable: it processed a digital insurance claim in three seconds, from filing to payout. It has also identified a large number of insurance fraud attempts, saving insurance providers millions.

2. Omnichannel customer experience tools improving policyholder communication

Providing an omnichannel customer experience (CX) means meeting your customers where they are and communicating relevant information to them regularly. Your customers need to be able to buy policies, process claims, and more on both web and mobile devices. Insurance providers that meet those demands will find that their customers are more loyal and less likely to churn.

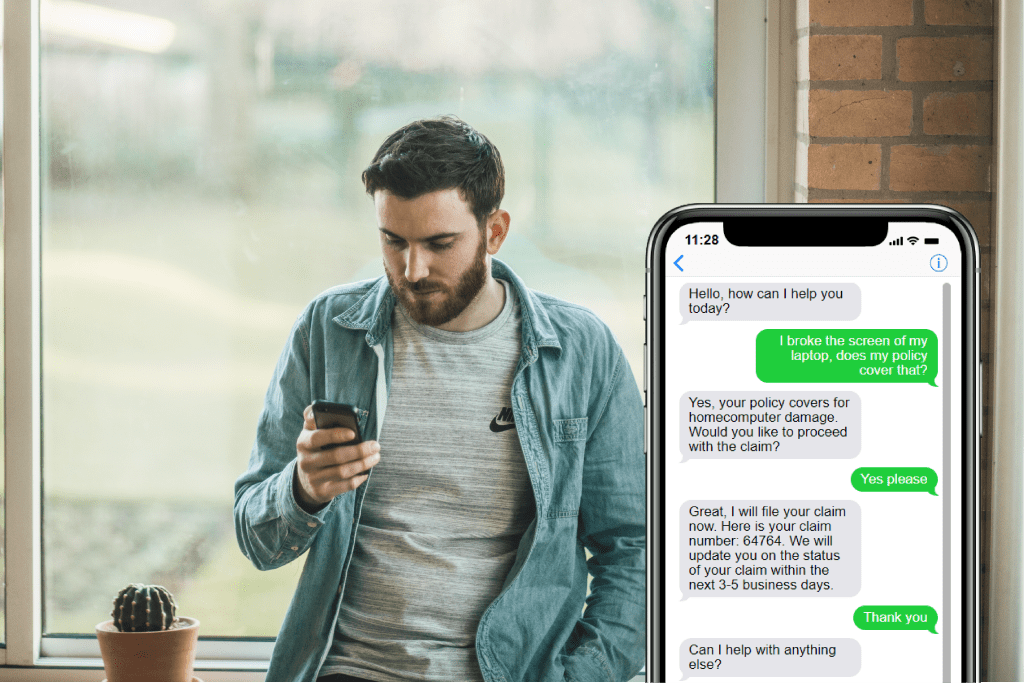

Omnichannel CX also means providing customers with easy access to information, accurate and predictive customer service, and fast processing times across all platforms. According to Salesforce, 58% of customers say that their expectations have changed because of existing technological advancements, including omnichannel CX tools such as insurance chatbots. They want a more retail-like experience—easy access to your product offerings and quick responses from your customer service team.

Insurance chatbots help your firm educate your customers, collect customer feedback, and run simple processes. Artificial Solutions’ AI-powered chatbot is a great example of a conversational chatbot that communicates with customers using natural language. Customers can ask the bot questions, buy policies, file claims, and more using a faster and more streamlined process. Customers have a great experience, and you save time and money in manpower and support.

3. Telematics technology enables personalization at scale

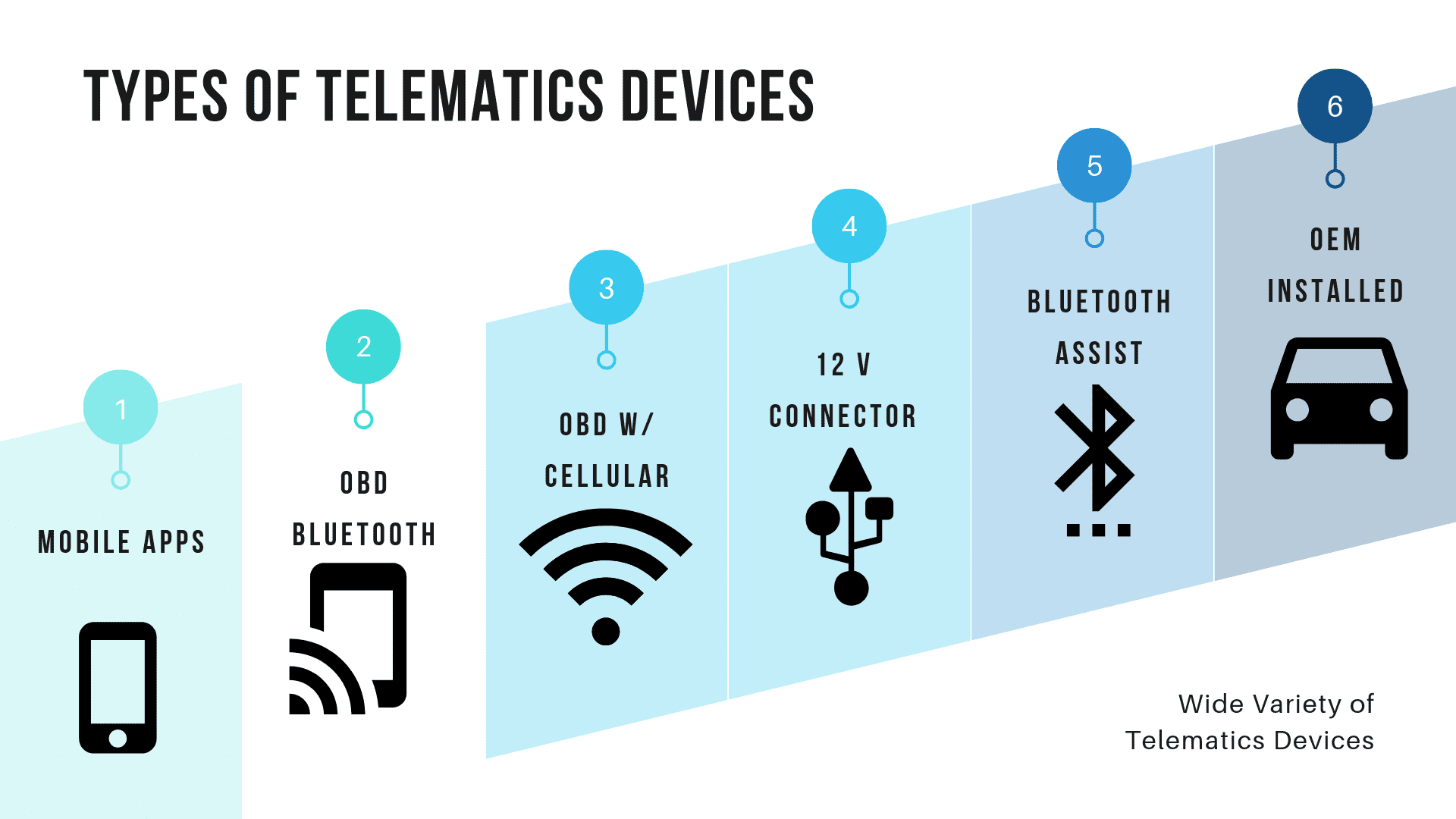

Telematics technology is data tracking software and hardware (think your cell phone, website cookies, global positioning systems [GPSs], and computers) that track users’ behavior with their consent. Before telematics, there was no way for insurers to track and influence policyholders’ behaviors. Insurers couldn’t assess risk on an individual level at scale, so they had to create policies based on general data instead of personal data.

Auto insurers have already started using telematics tools like GPS trackers and beacons to track data directly from customers’ cars and devices. With that data, insurers can anticipate changes in individual behavior to measure and reduce risks.

Insurers that use telematics and get the consent of their policyholders to track individual data can personalize policies and offer discounts that would not be possible otherwise. For example, instead of basing driving behavior on that of the general population, insurers can track an individual’s average driving speed, most-used route, rate of car usage, and more to give their customers policies that perfectly suit their needs.

Apart from tracking behavior, telematics has also enabled providers to influence behavior to reduce accidents. Fewer accidents mean fewer payouts. Insights from telematics help insurers make better decisions around underwriting and claims, in addition to personalized policies.

Insurers have also started looking at smart home devices outside of the auto insurance industry to further drive P&C insurance digital transformation. Smart home devices track home data, such as humidity and temperature, that can cause damage to a home over time.

4. Blockchain and smart contracts add transparency to P&C insurance industry

Blockchain is a digital ledger that records data in the form of “blocks” that become a permanent record once they are accepted “on-chain.” Blockchains are easily accessible by permitted parties through blockchain-based platforms. Smart contracts are lines of code stored on the blockchain that automate insurance claims processing to improve user experience and back-end efficiency. The smart contract is ultimately what would approve (or not approve) the conditions of a claim and send it off to be included in a block.

Without blockchain, when a customer decides to purchase a policy, there are four parties involved: the customer, the broker, the insurer, and the bank. But conversations only happen between two parties at a time—for example, the customer only talks to the broker, the broker only talks to the insurer, and so on. Information is passed from one party to another and gets held up or lost during the tedious back-and-forth.

It’s a long, convoluted process that lacks transparency and efficiency and usually provides a poor customer experience. It takes time for information from the bank to get back to the customer because that information has to go through two other parties.

Blockchain solves that problem because it is a decentralized system that removes the middleman and makes information more accessible. When a smart contract is created, it gets added to the blockchain for everyone to see. The blockchain-based smart contract then automates the tracking, management, and cloud storage of policies, records of physical assets, and claims-triggering events to increase back-end efficiency and front-end transparency. Instead of inefficient paperwork and slow communication, blockchain enables all information to be accessed by any party at any given moment.

To illustrate the process, the smart contract auto-initiates claims processing when certain conditions are met (e.g., policy expiration). Each piece of new information that gets executed through a smart contract gets entered into another block on-chain that would be accessible for all relevant parties to access.

5. Digital adoption platforms improving agent productivity & performance

P&C insurance digital transformation requires an upgraded tech stack and updated processes that theoretically save you time and money. But if your agents don’t know how to use your tech stack or complete your processes, then the time and money you would have saved are wasted.

Unfortunately, you can’t use traditional classroom training methods to train your newly digital workforce because they are outdated, time-consuming, and not collaborative enough for digital learning. You need to digitize and update your agent training methods to increase agent efficiency and reduce redundancy. A digital adoption platform (DAP) is training technology that integrates with your tech stack to walk your customers and employees through important processes and provide an easily searchable help content database.

It has features like walk-throughs, contextual self-help widgets, pop-ups, smart tips, and AI-powered chat interfaces to help your employees through your various processes. It also supports your employees by providing contextual, automated guidance technology to reduce errors and increase performance. Use all of a DAP’s features to increase agent efficiency and improve the customer experience.

One example of how DAPs can drive efficiencies in the insurance industry is Sentry Insurance, which created end-user training 40% faster with Whatfix. They used Whatfix features to create and deploy training modules across six different applications for over 77,000 people.

Challenges for P&C Insurance Digital Transformation

Seventy-three percent of enterprises failed to derive any benefits for their business from digital transformation. Here are some of the top insurance challenges when it comes to digital transformation:

1. Inefficient change management

The digital transformation causes companies to “change the organization, talent model, policies, processes and procedures – basically, the entire service model or business model,” Peter Bendor-Samuel, CEO of Everest Group, notes. Leaders who fail to manage this change will struggle with digital transformation.

It’s no wonder 42% of companies cite change management as an important factor in digital transformation. To reap the benefits of a digital overhaul, leaders must clearly communicate the degree of change and retire old processes. Merely implementing new technology is not enough.

2. Dependence on legacy systems

In 2016, a CAST software study found 69% of insurance organizations in eight countries were run largely on COBOL applications. This is a decades-old technology that needs regular maintenance, is often deprioritized by developers in favor of new technologies, and presents serious security threats. Another 2018 study confirmed legacy systems were still a barrier to digital transformation for insurance companies.

What’s more, even when insurers build a new claims platform or a billing system, they “tend to keep the old systems and build a layer on top,” says Mark Andrews, domain director at a UK-based consultancy.

While such systems help companies present a digitally-forward picture to consumers, they “become more bloated over time creating layers of complexity.”

3. Lack of training and skills

Everest Group found a lack of internal skills and talent to be a major barrier in technology adoption among insurance companies.

There’s also a high skills gap in three major areas driving innovation in P&C insurance: artificial intelligence, cybersecurity, and the internet of things.

Additionally, insurance companies also need to train employees once they switch to new systems. Inadequate training results in low adoption and little value for employees.

One survey found employees considered adequate tools and proper training as important job characteristics. When employers failed to provide adequate training, it made their job difficult and they were more likely to leave.

Fast-Track Digital Transformation for P&C Insurance with a Digital Adoption Platform

Digital adoption platforms (DAPs) help companies tackle change management, the lack of digital proficiency, and an affinity for legacy systems, all at once. They empower employees to get the maximum value out of your P&C core platforms for billing, underwriting, policy issuance, and claims management.

While employees use the platform, a DAP provides step-by-step walkthroughs, self-help widgets, and videos, to improve usability.

Let’s take a closer look at how DAPs such as Whatfix help insurers improve digital adoption of core P&C platforms and accelerate digital transformation:

- Interactive guides: Instead of overwhelming agents with mounds of documentation, DAPs provide contextual cues as they try to navigate your core platform. This reduces ramp-up time for policy agents. It’s also a better way to train independent insurance agents who may work with multiple platforms and providers at a time.

- Microlearning paths: With a DAP, you can break down different platform components into small sets of sequential courses, such as claims, underwriting, and billing. You can also assign goal-based tasks to each agent based on their proficiency with the platform and track the completion of tasks

- Contextual learning: All content is surfaced as and when a user reaches a specific feature of the platform. For example, if an employee is in the “Claims” tab, they’ll only see learning material relevant to that section.

- Automated form filling: DAPs reduce friction by auto-filling form fields such as claim type and loss type, based on their specialty. In turn, this reduces the time for policy processing.

- Compliance reminders: Insurance is a heavily regulated industry, with small errors resulting in huge losses. A DAP provides helpful pop-up reminders to insurers as they process claims, so they don’t make a compliance error.

All in all, a DAP helps insurers train agents and employees at scale, automate repetitive parts of their work, and improve compliance.

Digital transformation in P&C insurance doesn’t end with buying a new CRM or building a claims bot; it starts there.

As one study on software usage shows, enterprise companies use 288 SaaS apps each year, but they also churn through over 30% of them. The annual wastage on orphaned apps for mid-market companies stands at $135,000.

To transition to new technologies and get maximum value, CIOs must clearly convey the benefits of new processes, wean their teams off of older systems, and invest sufficient resources in employee training.

A digital adoption platform such as Whatfix helps companies meet each of these goals in a measurable, scalable way.

Want to learn how the Whatfix DAP can drive digital transformation in the P&C insurance industry? Request a demo today.

Request a demo to see how Whatfix empowers organizations to improve end-user adoption and provide on-demand customer support

Thank you for subscribing!